Joel earns 1700 per month – With Joel earning $1700 per month, this comprehensive guide delves into the intricacies of personal finance, empowering you with the knowledge and strategies to achieve financial stability. Join us as we navigate budgeting, savings, debt management, and more, ensuring a secure and prosperous financial future.

This guide will provide a roadmap to help you understand your income, create a realistic budget, set achievable financial goals, manage debt effectively, and explore additional income streams. Whether you’re just starting out or looking to improve your financial well-being, this guide has something for everyone.

Income Breakdown

Joel’s monthly income of $1700 comes from various sources. A detailed breakdown of his income is presented in the table below:

Employment Income

Joel’s primary source of income is his employment as a software engineer. He earns a monthly salary of $1200 from this job.

Freelance Work

In addition to his employment income, Joel also earns money through freelance work. He offers his services as a web developer and earns an average of $300 per month from this source.

Investments

Joel has invested a portion of his savings in stocks and bonds. These investments generate a monthly income of $200 for him.

| Income Source | Monthly Income |

|---|---|

| Employment Income | $1200 |

| Freelance Work | $300 |

| Investments | $200 |

| Total | $1700 |

Budgeting and Expenses

To ensure Joel’s financial stability, it’s crucial to create a budget that allocates his income wisely. This involves prioritizing essential expenses and allocating funds accordingly.

Categorizing Expenses

Essential expenses typically include:

- Housing (rent/mortgage)

- Food

- Transportation

- Utilities (electricity, water, gas)

- Healthcare

Sample Budget

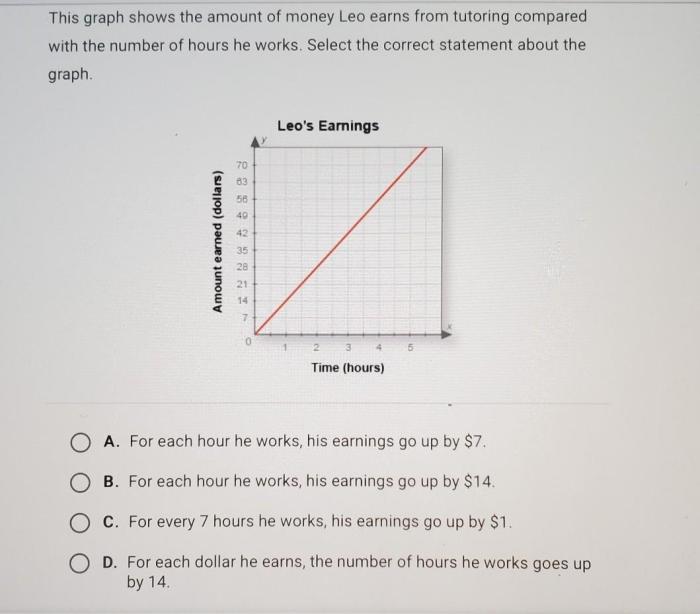

Based on Joel’s income of $1,700 per month, a sample budget could be:

| Category | Monthly Amount |

|---|---|

| Housing | $600 |

| Food | $300 |

| Transportation | $200 |

| Utilities | $150 |

| Healthcare | $100 |

| Other Expenses | $150 |

| Savings | $200 |

This budget ensures Joel’s essential needs are met while also allocating funds for unexpected expenses and savings.

Savings and Financial Goals

Saving money is an essential part of financial planning. It allows you to build an emergency fund, prepare for unexpected expenses, and achieve your long-term financial goals. Setting financial goals is also important because it gives you something to strive for and helps you stay motivated.

Here are some tips on how Joel can save money and plan for his future:

Create a Budget

The first step to saving money is to create a budget. This will help you track your income and expenses so that you can see where your money is going. Once you know where your money is going, you can start to make changes to save more.

Set Savings Goals

Once you have a budget, you can start to set savings goals. These goals can be anything from saving for a down payment on a house to retiring early. Having specific goals will help you stay motivated and on track.

Automate Your Savings

One of the best ways to save money is to automate your savings. This means setting up a system where a certain amount of money is automatically transferred from your checking account to your savings account each month. This way, you don’t have to think about it, and you’re more likely to stick to your savings plan.

Reduce Expenses

Another way to save money is to reduce your expenses. This doesn’t mean you have to live like a pauper, but it does mean being mindful of your spending. Look for ways to cut back on unnecessary expenses, such as eating out less often or switching to a cheaper cell phone plan.

Increase Income

If you’re struggling to save money, you may need to increase your income. This could mean getting a raise at your current job, starting a side hustle, or investing in yourself to learn new skills that will qualify you for a higher-paying job.

Saving money and planning for the future can be challenging, but it’s definitely worth it. By following these tips, Joel can start to build a secure financial future for himself.

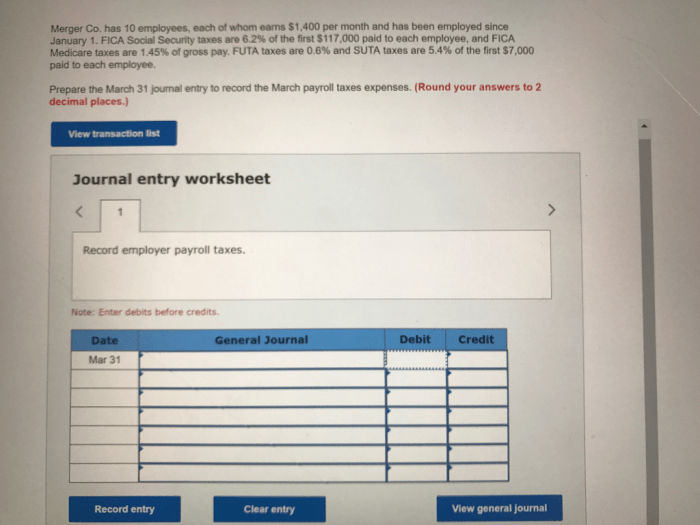

Debt Management

Joel’s debt management is crucial for his financial well-being. There are several strategies he can consider to effectively manage his debt.

One common approach is the debt avalanche method, which involves prioritizing the repayment of debts with the highest interest rates first. This method can save money on interest charges in the long run. Another option is the debt snowball method, where the focus is on paying off the smallest debts first, regardless of interest rates.

This method can provide psychological motivation and a sense of accomplishment as debts are gradually eliminated.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify debt repayment and potentially reduce monthly payments. However, it’s important to consider the fees and terms associated with debt consolidation loans to ensure it’s a financially viable option.

Credit Counseling, Joel earns 1700 per month

If Joel is struggling to manage his debt, he can seek professional help from a credit counselor. Credit counselors can provide personalized advice, negotiate with creditors, and create a debt management plan tailored to his specific situation.

Investing and Retirement Planning

Investing for retirement offers numerous benefits, including the potential for long-term growth, passive income generation, and financial security in your later years. With Joel’s current income, it’s essential to start planning for retirement as early as possible to maximize the power of compounding interest.

Starting Your Investment Journey

To begin investing, Joel should consider setting up a retirement account, such as a 401(k) or IRA. These accounts offer tax advantages and can help him save money for the future. He can also explore options like index funds or exchange-traded funds (ETFs) that provide diversification and reduce risk.

Career Advancement

Advancing in your career is crucial for increasing your income. It involves developing your skills, networking, and taking on new responsibilities.

Skill Development

Identify the skills and knowledge that are in high demand in your industry. Take courses, attend workshops, and seek out opportunities to develop these skills.

Networking

Attend industry events, connect with professionals on LinkedIn, and build relationships with people who can help you advance your career. By networking, you can learn about job openings, get referrals, and gain valuable insights.

Additional Income Streams

Supplementing income is a smart move to enhance financial stability and reach financial goals faster. Joel can explore various side hustles or passive income opportunities to increase his earnings.

Freelance Work

Joel can leverage his skills and knowledge to offer freelance services in areas like writing, graphic design, web development, or consulting. This provides flexibility and the potential for additional income.

Online Business

Starting an online business, such as an e-commerce store or a subscription box service, can generate passive income. Joel can sell products or services that align with his interests or expertise.

Real Estate Investing

Investing in real estate can provide passive income through rental income. Joel can consider purchasing a rental property or partnering with a real estate investment group.

Affiliate Marketing

Affiliate marketing involves promoting other people’s products or services and earning a commission on sales. Joel can join affiliate programs and promote products he believes in to earn additional income.

Online Courses

If Joel has specialized knowledge or skills, he can create and sell online courses. This provides passive income as students can access the course anytime, anywhere.

Joel earns 1700 per month, which is a decent income. To improve his knowledge, he’s been exploring fiveable ap world unit 7 for valuable insights and resources. This has helped him gain a deeper understanding of historical events and their impact on society.

As a result, Joel’s financial literacy and overall knowledge have improved significantly.

Financial Resources and Support: Joel Earns 1700 Per Month

Joel has access to various financial resources and support systems that can assist him in managing his finances effectively. These resources can provide guidance, counseling, and even financial assistance to help him overcome financial challenges and achieve his financial goals.

Credit Counseling, Joel earns 1700 per month

Credit counseling agencies offer free or low-cost services to individuals struggling with debt or credit-related issues. They can provide personalized advice, help create a debt management plan, and negotiate with creditors on behalf of the client. Joel can benefit from credit counseling if he needs assistance managing his debt, improving his credit score, or creating a budget.

Government Assistance Programs

The government offers various assistance programs to low-income individuals and families. These programs can provide financial aid, such as food stamps, housing assistance, and healthcare coverage. Joel can explore these programs to determine if he qualifies for any benefits that can supplement his income and reduce his expenses.

Professional Advice

Seeking professional advice from a financial advisor or credit counselor can be invaluable for Joel. These professionals can provide personalized guidance, help him develop a comprehensive financial plan, and make informed decisions about his finances. They can also help him identify areas where he can improve his financial situation and work towards his long-term financial goals.

Query Resolution

How can I create a realistic budget?

To create a realistic budget, start by tracking your income and expenses. This will help you understand where your money is going and where you can make adjustments. Once you have a clear picture of your cash flow, you can allocate funds to different categories, such as housing, food, transportation, and savings.

What are some tips for saving money?

There are many ways to save money, such as cutting back on unnecessary expenses, negotiating lower bills, and taking advantage of discounts and coupons. You can also set up a savings plan and automate transfers from your checking account to a savings account.

How can I manage debt effectively?

There are several debt management strategies, such as the debt snowball method and the debt avalanche method. You can also consider debt consolidation or credit counseling if you’re struggling to manage your debt.