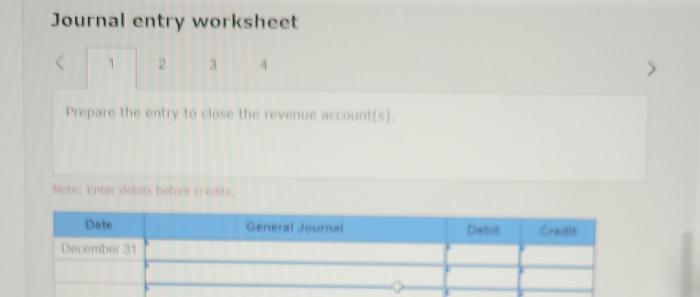

Prepare the closing entries for the year ended december 31 – As the fiscal year draws to a close, the meticulous preparation of closing entries for the year ended December 31 takes center stage. This comprehensive guide delves into the intricacies of this crucial accounting process, providing a detailed roadmap for ensuring accurate and reliable financial reporting.

By addressing key concepts such as accrued expenses, deferred revenue, depreciation and amortization, inventory adjustments, bad debt expense, income tax expense, and retained earnings, this guide empowers accountants and finance professionals with the knowledge and techniques necessary to navigate the complexities of year-end closing.

Accrued Expenses: Prepare The Closing Entries For The Year Ended December 31

Accrued expenses are expenses that have been incurred but not yet paid as of the end of the accounting period. To record accrued expenses at the end of the year, businesses must estimate the amount of the expense that has been incurred but not yet paid and record it as a liability on the balance sheet.

Common examples of accrued expenses include salaries payable, interest payable, and property taxes payable. Accrued expenses can be calculated by multiplying the amount of the expense by the number of days that have elapsed since the expense was incurred but not yet paid.

Impact on Financial Statements, Prepare the closing entries for the year ended december 31

- Increase in liabilities

- Decrease in net income

Deferred Revenue

Deferred revenue is revenue that has been received but not yet earned as of the end of the accounting period. To record deferred revenue, businesses must estimate the amount of the revenue that has been received but not yet earned and record it as a liability on the balance sheet.

Common examples of deferred revenue include prepaid rent, prepaid insurance, and unearned subscription revenue. Deferred revenue can be calculated by multiplying the amount of the revenue by the number of months or years that the revenue covers.

Impact on Financial Statements, Prepare the closing entries for the year ended december 31

- Increase in liabilities

- Decrease in net income

Depreciation and Amortization

Depreciation and amortization are accounting methods used to allocate the cost of long-term assets over their useful lives. Depreciation is used for tangible assets, while amortization is used for intangible assets. The purpose of depreciation and amortization is to match the expense of the asset with the revenue it generates over its useful life.

Methods for Calculating Depreciation and Amortization

- Straight-line method

- Declining-balance method

- Units-of-production method

Impact on Financial Statements, Prepare the closing entries for the year ended december 31

- Decrease in net income

- Decrease in total assets

Inventory Adjustment

Inventory adjustments are made at the end of the accounting period to ensure that the inventory balance on the balance sheet is accurate. Inventory adjustments can be made for a variety of reasons, such as theft, damage, or obsolescence. To make an inventory adjustment, businesses must physically count the inventory on hand and compare it to the inventory balance on the books.

If there is a difference between the two balances, an adjustment must be made to the inventory account on the balance sheet.

Impact on Financial Statements, Prepare the closing entries for the year ended december 31

- Increase or decrease in inventory

- Increase or decrease in cost of goods sold

Bad Debt Expense

Bad debt expense is the expense that businesses incur when they are unable to collect on accounts receivable. To estimate bad debt expense, businesses must use a method that is appropriate for their industry and business model. Common methods for estimating bad debt expense include the aging of accounts receivable method and the percentage of sales method.

Impact on Financial Statements, Prepare the closing entries for the year ended december 31

- Decrease in net income

- Decrease in accounts receivable

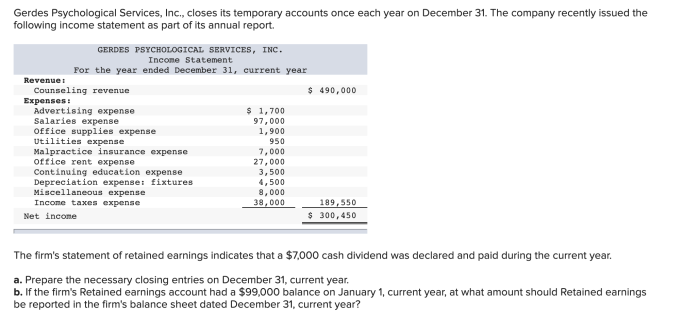

Income Tax Expense

Income tax expense is the expense that businesses incur when they pay taxes on their income. To calculate income tax expense, businesses must use the tax rates that are in effect for the year in which the income is earned.

Income tax expense can be calculated using the following formula:

“`Income tax expense = Taxable income x Tax rate“`

Impact on Financial Statements, Prepare the closing entries for the year ended december 31

- Decrease in net income

- Decrease in cash

Retained Earnings

Retained earnings are the earnings of a business that have been reinvested in the business. To calculate retained earnings, businesses must start with the net income for the year and then add back any dividends that were paid during the year.

The resulting amount is the retained earnings for the year.

Impact on Financial Statements, Prepare the closing entries for the year ended december 31

- Increase in equity

- Increase in total assets

Common Queries

What is the purpose of preparing closing entries?

Closing entries are prepared to temporarily close nominal accounts (revenue, expense, and temporary equity accounts) at the end of an accounting period, transferring their balances to retained earnings and preparing the accounts for the next period.

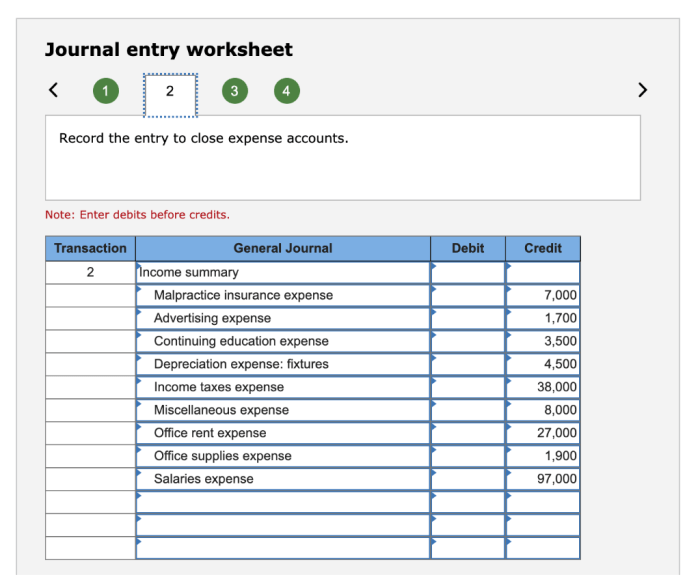

What types of accounts are closed during the closing process?

Nominal accounts, including revenue, expense, and temporary equity accounts, are closed during the closing process.

What is the impact of closing entries on the financial statements?

Closing entries ensure that the income statement reports the results of operations for the period and that the balance sheet reflects the financial position of the company at the end of the period.